All about Best Investment Books

Wiki Article

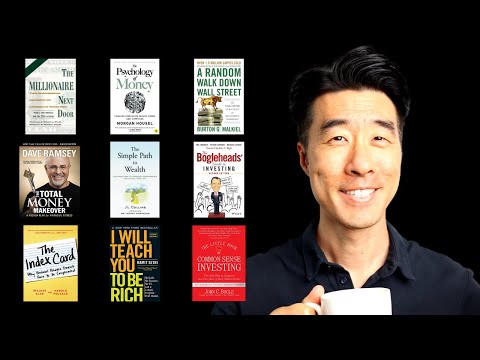

The very best Expense Books

Thinking about turning into a much better Trader? There are several textbooks that will help. Productive investors read extensively to establish their abilities and stay abreast of rising tactics for financial investment.

The Buzz on Best Investment Books

Benjamin Graham's The Smart Investor is an indispensable information for virtually any Trader. It addresses everything from essential investing procedures and risk mitigation strategies, to benefit investing methods and approaches.

Benjamin Graham's The Smart Investor is an indispensable information for virtually any Trader. It addresses everything from essential investing procedures and risk mitigation strategies, to benefit investing methods and approaches.one. The Little Ebook of Widespread Perception Investing by Peter Lynch

Penned in 1949, this common get the job done advocates the worth of investing with a margin of protection and preferring undervalued stocks. Essential-study for anyone considering investing, especially those hunting past index cash to determine certain significant-benefit prolonged-term investments. Additionally, it handles diversification concepts and also how to stay away from becoming mislead by market place fluctuations or other investor traps.

This reserve delivers an in-depth guideline regarding how to develop into a successful trader, outlining all the principles each individual trader should really know. Topics talked about inside the e book vary from current market psychology and paper buying and selling methods, preventing widespread pitfalls which include overtrading or speculation and more - building this guide necessary reading through for serious traders who want to ensure they have an in-depth knowledge of elementary buying and selling concepts.

Bogle wrote this in depth guide in 1999 to lose mild around the hidden service fees that exist inside of mutual money and why most investors would advantage extra from investing in reduced-cost index cash. His assistance of conserving for wet working day funds though not placing your eggs into 1 basket and investing in inexpensive index money stays valid nowadays as it absolutely was back again then.

Robert Kiyosaki has very long championed the necessity of diversifying revenue streams by real-estate and dividend investments, particularly property and dividends. Even though Wealthy Dad Bad Father may perhaps slide much more into private finance than private growth, Rich Father Lousy Father remains an educational read through for any person wishing to higher recognize compound curiosity and how to make their dollars get the job done for them as opposed to from them.

For one thing extra modern day, JL Collins' 2019 book can offer some Substantially-wanted point of view. Meant to tackle the desires of monetary independence/retire early communities (Hearth), it concentrates on achieving economic independence via frugal living, low price index investing as well as the 4% rule - and means to reduce university student loans, spend money on ESG assets and take full advantage of on-line investment means.

two. The Minor E-book of Stock Current market Investing by Benjamin Graham

Keen on investing but Uncertain how to progress? This e book offers practical advice prepared exclusively with young traders in mind, from significant college student loan credit card debt and aligning investments with particular values, to ESG investing and on-line monetary methods.

This most effective investment e-book displays you ways to recognize undervalued stocks and develop a portfolio that should give a steady supply of profits. Using an analogy from grocery shopping, this greatest e-book discusses why it is more prudent not to deal with pricey, nicely-promoted products but alternatively consider lower-priced, neglected types at income charges. Additionally, diversification, margin of security, and prioritizing benefit around advancement are all mentioned thoroughly all over.

A common in its field, this reserve explores the basics of benefit investing and how to establish options. Drawing on his expenditure corporation Gotham Resources which averaged an yearly return of 40 % in the course of 20 years. He emphasizes preventing fads when paying for undervalued providers with potent earnings prospective customers and disregarding brief-expression market place fluctuations as significant rules of prosperous investing.

This greatest expense ebook's author provides advice for new investors to stay away from the blunders most novices make and improve the return on their dollars. With action-by-step Guidelines on creating a portfolio built to steadily grow as time passes and the writer highlighting why index money offer probably the most economical implies of financial investment, it teaches visitors how to take care of their system no matter marketplace fluctuations.

The 45-Second Trick For Best Investment Books

Whilst very first revealed in 1923, this book continues to be an a must have guidebook for anybody keen on managing their finances and investing properly. It chronicles Jesse Livermore's ordeals - who acquired and lost thousands and thousands around his lifetime - though highlighting the importance of probability theory as Component of final decision-earning processes.

Whilst very first revealed in 1923, this book continues to be an a must have guidebook for anybody keen on managing their finances and investing properly. It chronicles Jesse Livermore's ordeals - who acquired and lost thousands and thousands around his lifetime - though highlighting the importance of probability theory as Component of final decision-earning processes.For anyone who is looking for to transform your investing abilities, you will find a lot of great books on the market that you should pick out. But with limited hours in per day and minimal available reading content, prioritizing only All those insights which supply quite possibly the most value can be tough - which is why the Blinkist application presents these quick access. By accumulating vital insights from nonfiction guides into Chunk-sized explainers.

three. The Little Ebook of Price Investing by Robert Kiyosaki

Best Investment Books for Dummies

This ebook covers purchasing enterprises with an financial moat - or competitive edge - for instance an economic moat. The creator describes what an economic moat is and gives examples have a peek at this web-site of a number of the most renowned firms with one particular. Additionally, this e-book aspects how to find out an organization's price and buy shares according to rate-earnings ratio - perfect for novice buyers or any person attempting to learn the basics of investing.

This ebook covers purchasing enterprises with an financial moat - or competitive edge - for instance an economic moat. The creator describes what an economic moat is and gives examples have a peek at this web-site of a number of the most renowned firms with one particular. Additionally, this e-book aspects how to find out an organization's price and buy shares according to rate-earnings ratio - perfect for novice buyers or any person attempting to learn the basics of investing.This doorstop investment reserve is equally well known and extensive. It addresses most of the ideal methods of investing, which include starting off young, diversifying extensively and not paying superior broker service fees. Created in an enticing "kick up your butt" model which may both endear it to viewers or flip you off fully; whilst masking lots of common pieces of recommendation (invest early when Other folks are greedy; be cautious when Other folks turn out to be overexuberant), this textual content also recommends an indexing method which seriously emphasizes bonds as compared to many related procedures.

This e book offers an insightful tactic for stock selecting. The writer describes how to select winning shares by classifying them into six unique categories - gradual growers, stalwarts, fast growers, cyclical shares, turnarounds and asset source plays. By subsequent this straightforward process you raise your odds of beating the marketplace.

Peter Lynch is among the planet's premier fund administrators, acquiring operate Fidelity's Magellan Fund for 13 many years with a median return that conquer the S&P Index annually. Revealed in 2000, his e-book highlights Lynch's philosophy for choosing stocks for specific buyers in an accessible manner that stands in stark contrast to Wall Road's arrogant and extremely complex technique.